The law introducing the new organization of the electricity market (NOME) was promulgated on December 8, 2010. It implemented the regulated access of alternative suppliers to electricity produced by EDF's nuclear power plants (ARENH). This ARENH system is based on three pillars: a guaranteed maximum volume of nuclear-origin electricity for suppliers; the adaptation of regulated electricity selling prices: an ARENH price reflecting the economic conditions of production of electricity from nuclear power plants.

The third pillar is crucial simply because the price of ARENH must be neither too high compared to the cost of production of nuclear electricity (this would penalize the suppliers), nor too low (this would penalize the producer, namely EDF). It is essentially a question of a "fair" transfer of margin (or "nuclear rent") between producer and suppliers.

Therefore, in order to ensure a fair remuneration to EDF and to guarantee alternative suppliers economic conditions equivalent to those resulting for EDF from the use of its historical nuclear power plants, the law stipulates that the price of ARENH must be representative of the economic conditions of production of electricity by the historical nuclear power plants over the duration of the device.

In other words, the price of ARENH must reflect the full costs of the historical nuclear fleet.

The NOME law stipulates that these full costs are composed of:

The ministers, in charge of setting the level of the ARENH price, have set it at:

This slight increase aims, from a prudent perspective, to allow EDF to make the necessary security investments, the level and schedule of which are particularly uncertain following the accident at the Fukushima nuclear power plant in Japan.

Some parameters such as the cost of decommissioning remain difficult to evaluate and illustrate the problem of the objectivity and verification of the full costs of the French nuclear fleet. Thus, some alternative producers argue that the price of ARENH is between €5 and €7/MWh higher than reality. On the contrary, EDF advocates that this price level is the minimum allowing it to cover all charges.

Finally, let's note that many other devices could have been imagined:

The law establishing a new organization of the electricity market (NOME) was enacted on December 8, 2010. It introduced the regulated access of alternative suppliers to the electricity produced by EDF's nuclear power plants (ARENH).

Originally, the NOME law, according to the Energy Regulatory Commission (CRE), aimed to enable an effective market opening, and to lessen the impact of the quasi-monopoly on the nuclear electricity production sector in France by EDF. For its part, the European Commission, following an investigation procedure under state aid rules, considered that the existence of regulated electricity sale tariffs (TRV) combined with insufficient access of EDF's competitors to electricity sources as competitive as the historical nuclear park constitutes a barrier to the development of effective competition.

Indeed, in the wholesale electricity market, each electron is sold at a price that is determined by the marginal cost of electricity produced by the least competitive primary source required (thermal power plant, for example). However, as nuclear electricity is the most competitive, each electron produced by a nuclear power plant generates a rent for its operator, called the "nuclear rent". This rent has long made it possible to build regulated tariffs based on the marginal costs associated with nuclear electricity, which only EDF has the right to produce in France.

Under these conditions, it was legitimate to question the real possibility for an alternative supplier to offer competitive prices to the end consumer, without having electricity produced at the marginal cost of nuclear power.

In this context, the NOME law, in line with the work of the Champsaur Commission, has the objective to:

With an installed capacity of 3027 MW thanks to 2203 wind turbines installed in 2007, France is only ranked 5th in Europe and the annual production (4.2 TWh) represents only 1% of the total energy consumption. In this context, the government has decided to support the development of the sector by imposing an obligation to buy by Electricity of France, or non-nationalized distributors, of the electricity produced by installations using the mechanical energy of the wind. The decree of July 10, 2006, which should be quickly replaced by a similar decree of the ministry in charge of Energy following its cancellation by the Conseil d'Etat (see Marion Lettry's interview in this newsletter), defined the purchase tariffs and their annual indexing for installations after the date of its publication, July 26, 2006. Understanding the principles of this indexing is better securing the business plan of one's investment. This article highlights the consequences of annual indexing on the purchasing tariff levels of on-shore wind electricity during the first ten years of the investment cycle.

If the basic purchase price (Tb) of the production of an on-shore wind turbine is initially 8.2 c€/kWh if the complete application was filed in 2006, the investor must actually consider an indexing procedure throughout the life of the installation. This indexing is double and depends mainly on the date of the complete application by the operator, and not on the commissioning date of the installation: the initial indexing as of the date of the complete application can obtain the initial tariff (T0) by multiplying the basic purchase rate (Tb) by a coefficient K(AA) from the beginning of commissioning. This coefficient and the initial rate depend on the year of the complete application (AA): T0 = Tb • K(AA); annual indexing on November 1 allows to obtain the current tariff (T) by multiplying the basic purchase tariff (T0) by a coefficient L(11/AA, MM/YY) from November 1 of each year. This coefficient and the current tariff depend on the date of the complete application (MM/AA) and the considered November month (11/YY): T = T0 • L(11/AA, MM/YY).

Let us note that for a given project, the annual indexation takes place every year and the base tariff is therefore multiplied each year by the coefficient L of the November month of the considered year. Coefficients K and L thus depend on the evolution of two indices published monthly by INSEE the index of the hourly cost of labor in mechanical and electrical industries (ICHTTS1) and the producer price index of industry and business services for the entire industry (PPEI). It will be noted that if the ICHHTS1 and PPEI indices follow an exponential trend, this is not the case for the K and L coefficients, which are defined from the ICHTTS1 and PPEI indices by a complex formula.

Overall, the evolution of the two coefficients K and L each experiences two influences. The coefficient K (table 1) decreases wit

Whether you are in charge of development or considering the acquisition of a decentralized electricity production plant project, you must ensure that its electrical sizing complies with the technical prescriptions set by the regulations and approved by energy regulators.

Most importantly, you want to optimize the connection timeframes and costs, key variables for operational control and financial valuation of your project. To achieve this, you should anticipate the reference connection solutions that will be costed by the transport network operators (RTE) or distribution network operators (ERDF, GEREDIS, etc.) in their connection studies or in their technical and financial proposals.

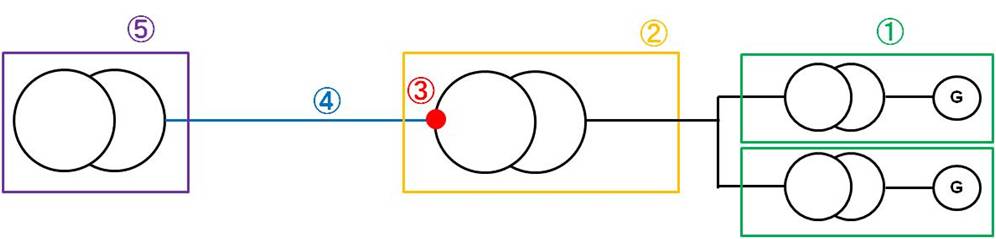

Your electricity generation plant project, whether it is structured in one or more production units

① is your responsibility (ownership, operation) up to the delivery point

② which materializes the property limit

③ and operation between the indoor installation and the connection link.

④ It is the connection link that connects you to the source-infrastructure

⑤ of the electricity distribution or transport network: it is dedicated to your plant project, financed by you, but it is the network manager who is the exclusive owner and operator.

A connection solution includes the connection link and the source-infrastructure of the connection. The network manager describes, in his studies and connection offers (PTF, connection agreement), the technical and economic terms of this connection solution:

Connection timeframes mainly depend on the administrative procedures specific to the construction of electricity transport and distribution infrastructures, which the network manager will have to carry out in parallel with the project's connection procedure (technical and financial proposal, connection agreement, operating agreement, etc.).

Connection timeframes end with the commissioning of the connection which, for some primary sources of renewable energy, corresponds to the start of the purchase obligation.

Connection costs, which are quoted by the network manager, cover the construction of the connection link, but do not include the electrical equipment of the indoor installation. All of these costs are at your expense, but you will neither be the owner, nor the operator of the connection link, since the property limit is located at the delivery point.

These connection costs are distinct from the network access costs that you will have to pay during the operation period of your plant, once it is connected and put into service.

In principle, a plant project is connected to the territorially competent network that operates infrastructures at the connection voltage that is consistent with the project's power. The project must also be connected individually in antenna to the nearest source-station, where the superior voltage is available.

In reality, the network manager is often led to study other connection solutions that may be less expensive or faster to implement. The optimal solution is the reference connection solution.

However, if the network manager has, in return for his territorial monopoly, the obligation to propose the best connection solution in terms of timeframes and costs, it is indeed up to the applicant to choose the solution he prefers. Connecting to the electricity network therefore involves a negotiation that the developer must conduct.

For this purpose, the regulations have provided certain provisions: obligation to pool the connection costs of two production installations with the agreement of the respective developers, possibility to detail and justify the timeframes and connection costs quoted by the network manager, opportunities for the project developer to choose a connection to a neighboring network if the local service network offers a less interesting connection, connection to the higher voltage (transport instead of distribution), direct line connection to the transport network without connecting to the distribution network, indirect connection of producers located upstream of a common infrastructure, etc.

Identify the connection networks to which your project can connect considering its technical characteristics, legal setup and location

Analyze the possibility and opportunity to implement the specificities offered by the regulation or the regulation

Anticipate the connection solutions that these network managers will be able to identify or that you will be able to propose them to take into account (antenna, break, derivation)

Estimate the available connection capacity and anticipate the layout of the connection link

Provide a first comparative estimate of the costs and timeframes associated with each of the connection solutions

The study of the technical conditions for connecting a conventional or renewable plant to the electricity transport or distribution networks is a complement to the technical due diligence.

It is necessary when it is needed to specifically and in detail examine whether the connection is optimized from a technical and electrical point of view (acceptable level of line losses to the delivery point, reasonable unavailability and erasure rates at the network level, ...), and, more generally, whether the design and operating conditions of the indoor electrical installation are compatible with that of the connection link to the electricity networks.

More specifically, it aims to:

identify possible inconsistencies between the design and operating conditions of the indoor installation and the connection infrastructure

validate the technical characteristics of the connection

quantify the uncertainties and risks that may have a negative impact on the park output

recommend realistic assumptions on these technical characteristics for the financial evaluation model

recommend, list and rank appropriate conditional terms or possible improvements

For a park or a plant in project, it is possible to complement the analysis of the only generally available documents (connection studies, technical and financial proposal) by a prospective analysis of the foreseeable connection agreement, operating agreement and network access contract, considering the current regulation and regulation

The cost of capital is generally calculated as the weighted sum of the costs of the different sources of financing used by a firm: equity and debt, in their usual distinction. The Weighted Average Cost of Capital is a fundamental element of corporate finance. Financial analysts, investors use it systematically when they seek to value and select their investments, whether it be shares or industrial projects. It thus serves as a discount rate applied to future cash flows to derive a net present value, or as a threshold value for estimating the profitability of an investment. In network industries subject to regulation, the WACC is also determined by regulators that directly affects operators' revenues. Applied to the Regulated Asset Base to obtain the capital charge, the fixed rate is a sensitive value in cost-oriented infrastructure pricing (operating and investment charges being more explicit).

The pre-tax cost of debt is usually modeled by the formula:

CD = Rf + d,

The Financial Asset Evaluation Model is most commonly used to determine the cost of after-tax equity:

CE = Rf + β.EMRP,

Thus, given the privileged tax treatment of debt, an after-tax formulation of the cost of capital is:

WACC = (1-g).( Rf +β.EMRP)+g.(1-t) ( Rf +d),

where: g is the leverage ratio, and t, the tax rate

In theory, the parameters of the WACC used in corporate finance are determined in a purely forward-looking way over the duration of the investment (even if, sometimes, past developments serve as a reference for this purpose). For example, the beta calculated from market data is reduced to an economic beta stripped of the effect of debt on the company's risk profile, then "re-indebted" with a forecasted leverage. The WACC used in valuation calculations should be constantly updated based on the most recent data, such as the prevailing risk-free rate.

For regulators, concern for the stability of the rate, invariant during the regulation period, is a predominant criterion in their judgment. This allows operators to have some visibility. Regulated rates also differ in that they incorporate "normative" rather than forward-looking parameters. For example, an operator whose financial structure is clearly "sub-optimal" and destined to remain so for a certain time should not be over-remunerated as a result. It should be noted that for this g parameter, energy infrastructure regulators consider book values (as a percentage of RAB) rather than market values, as practiced in traditional corporate finance.

Compared to brokerage firms, regulators are also faced with the question of differentiating the normative WACCs according to the type of infrastructure. Beta is the parameter whose determination is, in this respect, the most delicate. But this should not lead to the choice of a value corresponding to that of the multi-activity listed group that incorporates the one being analysed, even if the reasoning on its specific risk profile relies mainly on qualitative considerations. The definition of the WACC is simple. The estimation of each of the component parameters, on the other hand, is a complex exercise as soon as one tackles it with a level of rigour proportional to the stakes. In practice, financial analysts tend to neglect this calculation to communicate essentially on the various developments likely to affect forecasted cash flows. Alternative methods, like the Arbitrage Pricing Theory which bypasses the choice of a unique financial structure in discounting cash flows, are also used. With the RAB, regulators have less latitude to adjust prices without touching the WACC. Moreover, they are now required to communicate, or even consult, more transparently on this rate, or rather these rates by asset class. But the choices are sometimes insufficiently motivated or not robust to analysis despite appearances.

At the instigation of the Energy Regulation Commission and in collaboration with PMP, Zelya conducted an original study on the WACC in two parts. The first was to carry out an "intelligent" benchmark of the rates retained by other European energy regulators. These, in essence, are of little interest when we want to compare them to the French situation. They were therefore reprocessed infrastructure by infrastructure, first to cover the same definitions (pre or post-tax rates, nominal or real) and focus on the same economic context (taxes). They were then adjusted relative to the RABs which, themselves, do not have the same scope according to the regulators. Finally, a last treatment of a more qualitative order focused on the assessment of the impact of the regulation system (price-cap, pass-through, volume risk, etc.) on the risk profile of the activity compared to the French framework. This has made it possible to compare foreign rates in a much more relevant way than with a "raw" benchmark. The second part is the more classic "internal calculation", parameter by parameter. This was based on a plurality of sources including data collected from regulators, economic literature and reprocessed market information from Bloomberg data. To differentiate the analysis by activity, a benchmark operators (beta, g) was also necessary. The comparison of results and old regulated rates thus allowed the regulator to make an informed choice of the new values to be retained.